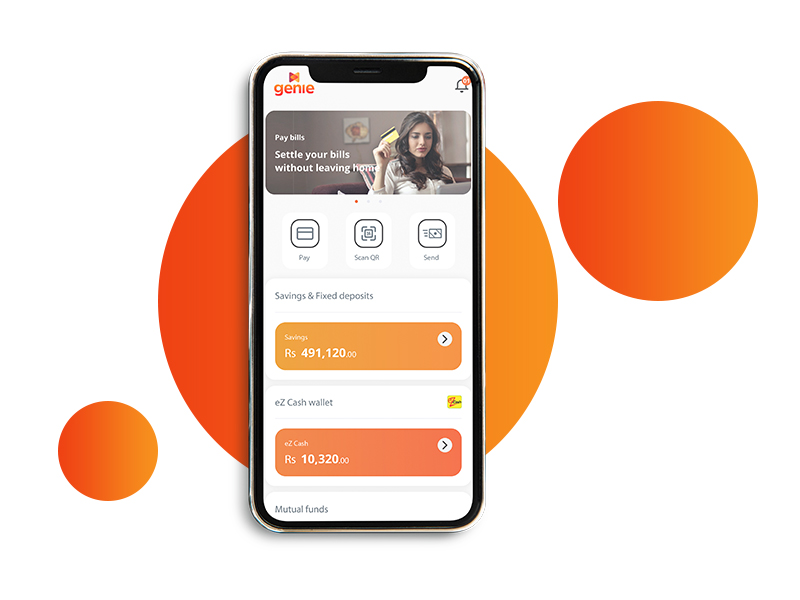

Have you been looking for smart ways to grow your wealth and invest in your future? Our Mutual Fund investment solution is ideal for those looking to begin their investment and wealth management journey.

With our partnership with Softlogic Invest, we are delighted to offer you the opportunity of making investments in the Softlogic Money Market Fund through Genie. You can start by investing as low as Rs. 5,000 and expect the best possible short-term returns, while having the assurance that your capital is cashable at any time. Why wait? Download Genie to your mobile phone, select the Mutual Funds option, create your account and start investing!