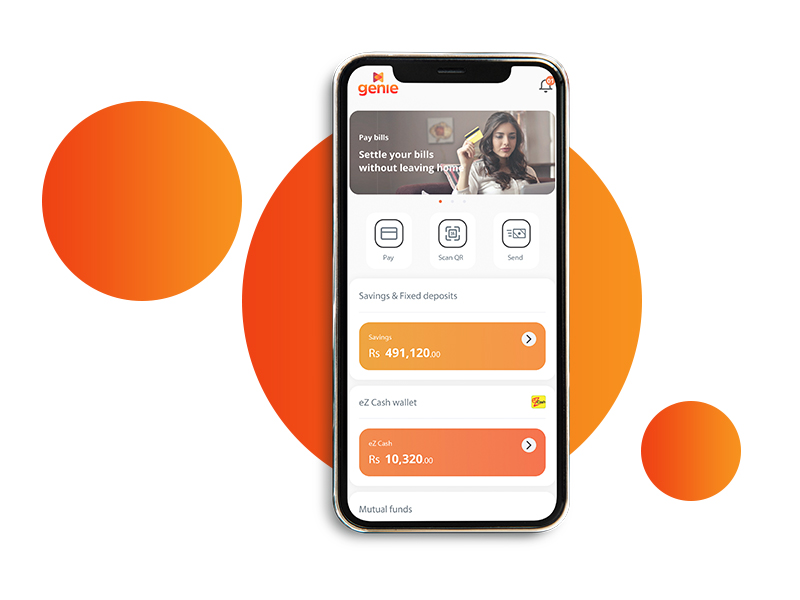

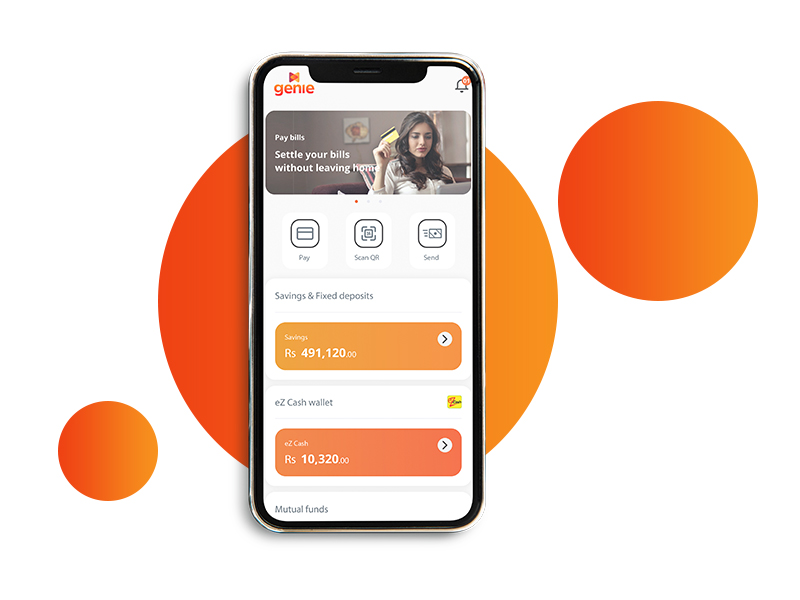

Now you can save as much as you want, as often as you want, with Goal Based Savings from Genie.

Our Goal Based Savings plans allow you to choose how much you want to save each month, depending on your final savings goal. You also have the freedom to select your savings maturity period and funding date based on your convenience. So, start your savings journey today with just a tap on your mobile screen, and get closer to reaching your financial goals.