Now you can easily update your genie registered mobile number or NIC through the genie app by submitting a service request!

Click here to learn more.

දැන් ඔබට genie ඇප් එක හරහා සේවා ඉල්ලීමක් ඉදිරිපත් කිරීමෙන් පහසුවෙන්ම ඔබගේ genie ලියාපදිංචි කළ ජංගම දුරකථන අංකය හෝ ජාතික හැඳුනුම්පත වෙනස් කිරීමට ඉල්ලුම් කල හැක.

මෙතන ක්ලික් කරන්න වැඩිදුර දැනගන්න.

இப்போது நீங்கள் genie App மூலம் சேவைக் கோரிக்கையைச் சமர்ப்பிப்பதன் மூலம், உங்கள் genie பதிவுசெய்யப்பட்ட கையடக்க தொலைபேசி இலக்கம் அல்லது தேசிய அடையாள அட்டையை மாற்றுவதற்கு இப்போது நீங்கள் எளிதாக விண்ணப்பிக்கலாம்.!

மேலும் தெரிந்துகொள்ள இங்கே க்ளிக் செய்யவும்.

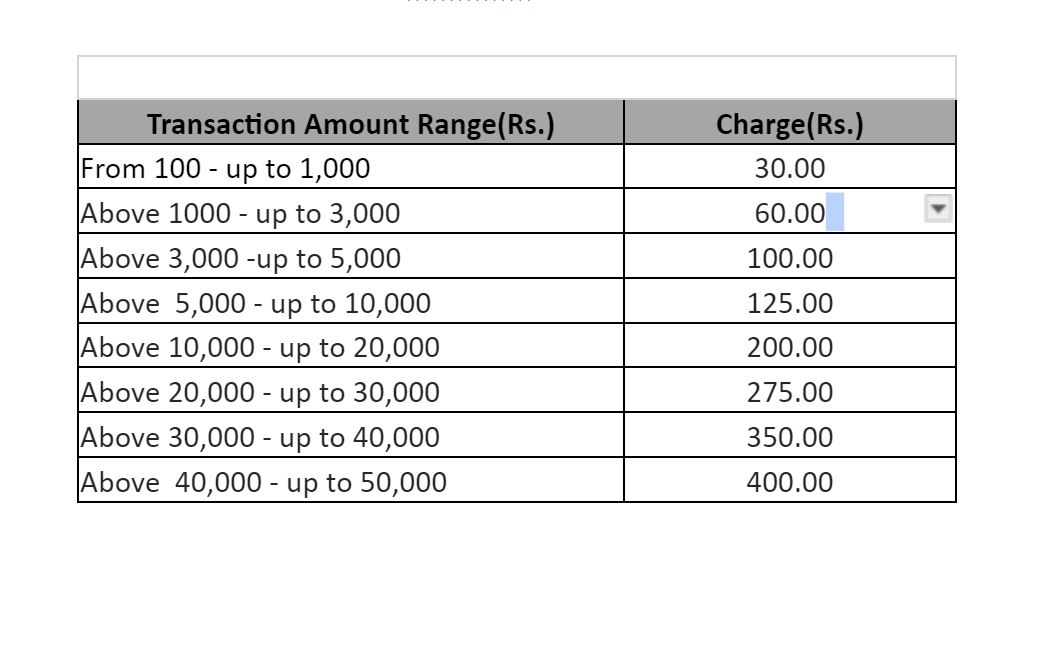

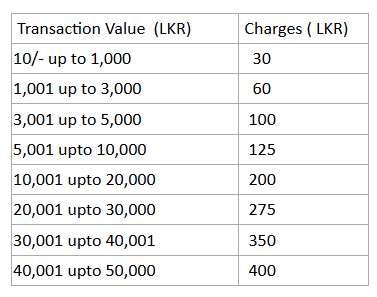

Additionally, other bank charges related to CEFT fund transfers will apply when using CEFT to fund the genie Savings Account, amounting to LKR 30/-.

Additionally, other bank charges related to CEFT fund transfers will apply when using CEFT to fund the genie Savings Account, amounting to LKR 30/-.