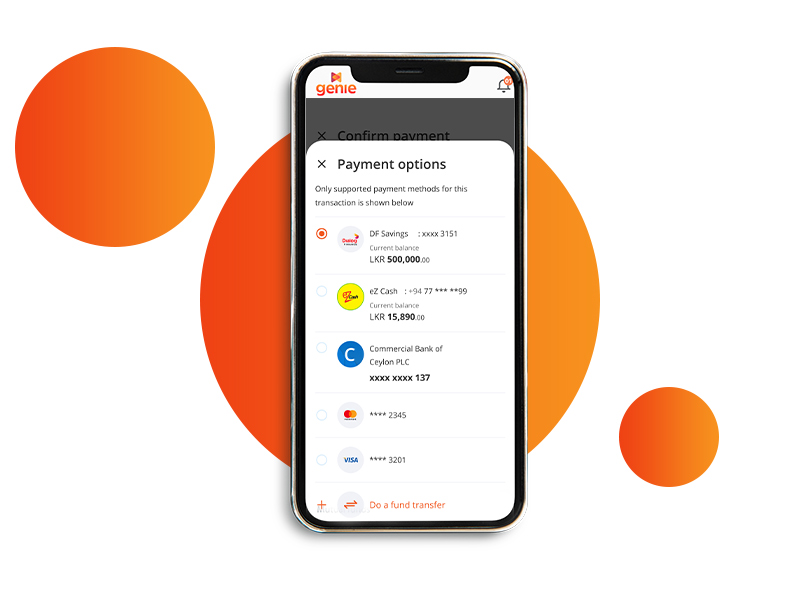

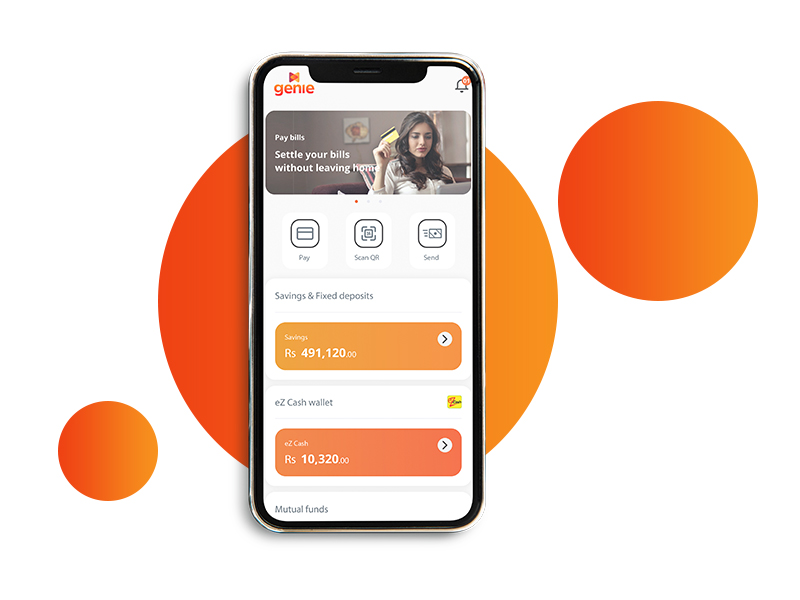

Experience a cool way to save at the convenience of your fingertips with Dialog Finance* Digital Savings Accounts. Make bill payments, scan and pay with LANKAQR codes, withdraw cash from any LankaPay enabled Debit, or even make fund transfers to other bank accounts, while earning attractive interest rates on your savings.

Our completely digitized onboarding process removes the trouble of standing in queues and saves time, making this the most hassle-free account opening process you will experience.