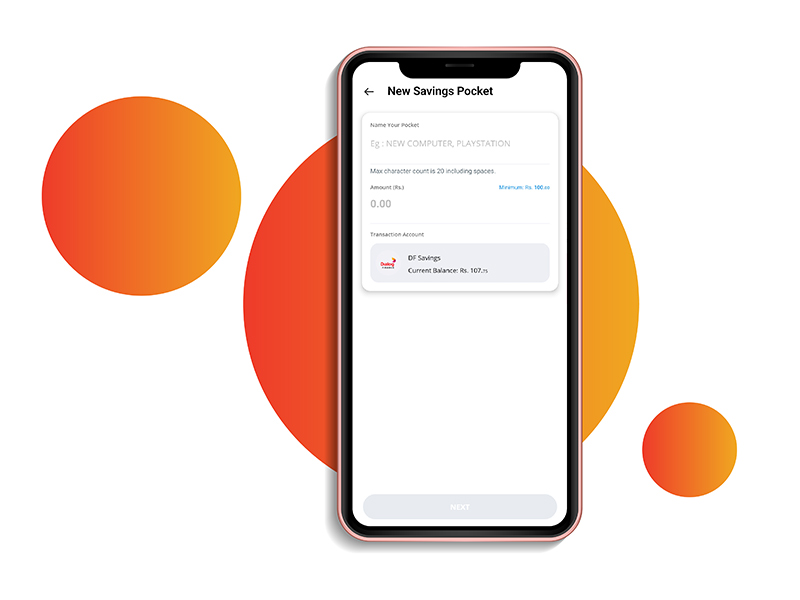

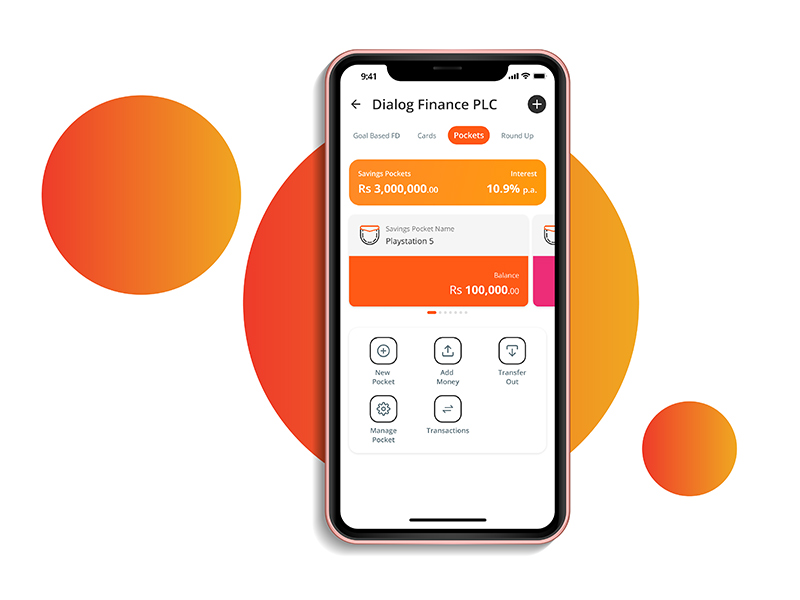

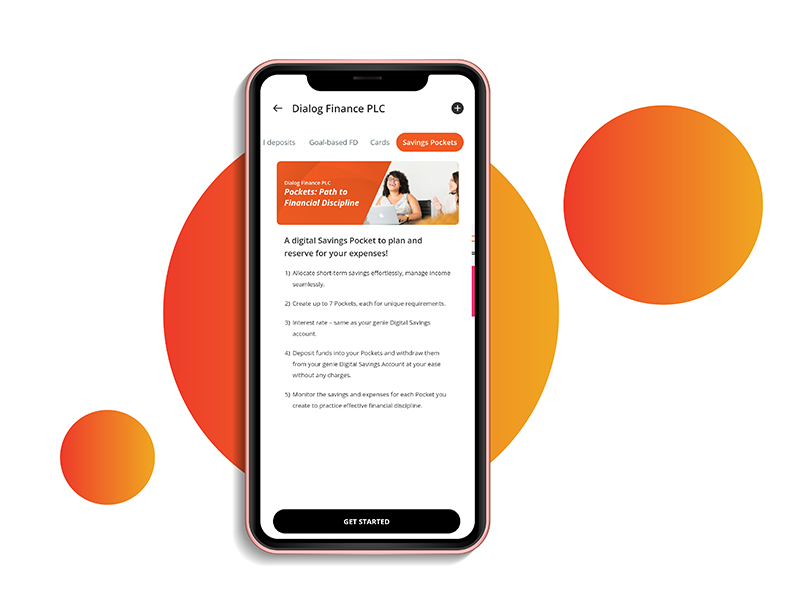

Embark on your path to financial discipline with our Savings Pockets—a simple tool designed to empower you on your path to financial discipline. Savings Pockets offer a simple way to plan and allocate your income seamlessly into designated pockets, ensuring your money goes where it matters most. With up to 7 customizable pockets, you can address a spectrum of daily, monthly, annual financial needs, from essential expenses to special occasions. Remember, financial discipline is not a destination but an ongoing journey. Cultivate discipline, and you’ll gain control over your money.