5.1 ACCEPTANCE OF GENIE

The Merchant shall:

a). promptly honour any payment request for a Transaction by a customer via GENIE ;

b). offer goods and/or services to customers who wish to make payments via GENIE on terms not less favourable than those offered to customers paying the Merchant through other means including cash;

c). not use GENIE for any unlawful or unauthorized purpose;

d). not require or post signs indicating that they require a minimum value for Transactions below which the Merchant shall refuse to honour payment through GENIE.

e). not accept any cash payment from a customer with respect to goods and/or services paid for via GENIE.

5.2 AUTHORIZATION AND SECURITY

5.2.1 The Merchant shall

a). before completing a Transaction, comply with all security procedures specified by DIALOG from time to time;

b). adhere to any directives, instructions or guidelines issued by DIALOG relating to security conditions and implement, maintain and operate technical integrations and /or security standards as required by DIALOG from time to time.

Any loss or damage caused to DIALOG or any third party due to the Merchant’s failure or delay in adhering to such procedures or requirements shall be the sole responsibility of the Merchant.

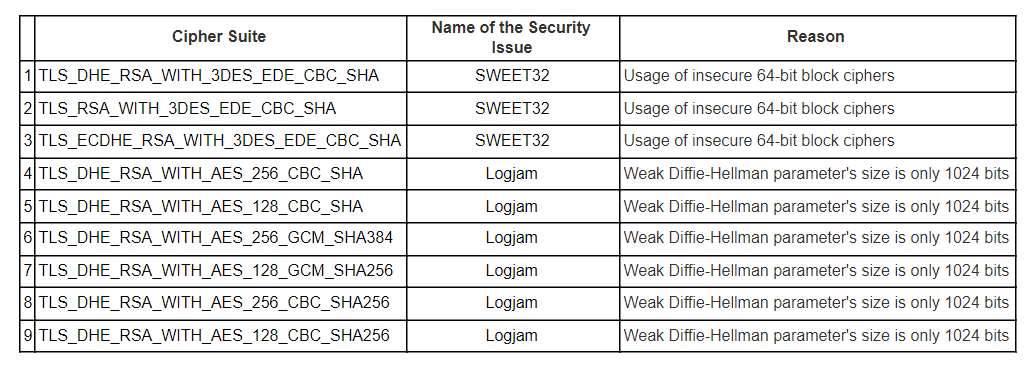

5.2.2 While adhering to security best practices, the Merchants are required to refrain from using the Insecure Protocol Suites set out in Schedule 1 hereto when making connection to https://extmife.dialog.lk from the Merchant’s Application.

5.2.3 The Merchant shall ensure that goods and/or services are delivered to the customers only after receiving appropriate authorisation for the Transaction.

5.2.4 The Merchant shall not effect two or more Transactions to avoid obtaining the relevant authorisations or to obtain authorisation which would not otherwise have been given. The Merchant shall not effect an Transaction when only a part of the amount due to the Merchant from the Customer is included as the transaction amount.

5.2.5 The Merchant acknowledges and accepts that the Merchant shall not be allowed to carry out Transactions if the Merchant is included in the black list of any bank.

5.3 The Merchant shall ensure that its staff:

a). is fully informed about GENIE, including the procedure for registration of customers;

b). are always courteous to the customers who wish to perform Transactions;

c). do not commit any act or omission in relation to GENIE, which may result in a claim or action against DIALOG or GENIE and/or cause any damage to the reputation, brand or image of DIALOG or GENIE;

5.4 PAYMENT CARD INFORMATION (DUTY TO NOTIFY)

a) The Merchant must notify DIALOG immediately if it knows or suspects that payment data belonging to DIALOG customers (“Cardholder Data”) held by it, or its Sub-contractors, has been accessed or used other than in accordance with this Agreement (“Unauthorized Use”).

b) The Merchant shall promptly provide to DIALOG the full details of the Unauthorized Use (including, without limitation, a breakdown of all information lost if taken) and audit reports of the Unauthorized Use.

c) The Merchant shall, at its own cost, prepare and implement, with DIALOG, a mitigation plan to rectify any issues arising from Unauthorized Use, including, without limitation, obtaining DIALOG’s advance input into and written approval of the Merchant’s communications to cardholders affected by the Unauthorized Use and providing to, or procuring for, DIALOG (and obtaining any waivers necessary to provide or procure) all relevant information to verify their ability to prevent future Unauthorized Use in a manner consistent with this Agreement.

d) The Merchant must engage, at its sole cost, an independent forensic investigator to conduct a thorough audit of any such Unauthorized Use, or the Merchant must provide (and obtain any waivers necessary to provide) to DIALOG, its forensic investigators and auditors, on request and at the Merchant’s sole cost, full cooperation and access to conduct a thorough audit of such Unauthorized Use. Audits conducted by the Merchant must include forensic reviews and reports on compliance, as well as any and all information related to the Unauthorized Use and must identify the cause of the Unauthorized Use and confirm whether or not the Merchant was in compliance with the PCI DSS at the time of the Unauthorized Use.

e) Without prejudice to the other rights and liabilities under the Agreement, the Merchant indemnifies Dialog for all fraudulent transactions related to such Unauthorized Use and all costs, fees, and expenses, including claims from other third parties and all costs incurred by Dialog as a result of the Unauthorized Use.

5.5 At the request of DIALOG, the Merchant shall submit to DIALOG an irrevocable, unconditional, and on demand bank guarantee (in a format agreeable to DIALOG) issued by a licensed commercial bank operating in Sri Lanka equivalent to the value indicated in the Front Sheet to be valid until the expiration or early termination of this Agreement, against all/any act/s of negligence, error or omission, wrong doing, breach of duty, dishonesty or infidelity, sabotage, cessation of work, work to rule, strikes, terrorism, assault or battery, loss/damage to property of DIALOG, breach of contractual liability under this Agreement and to hold DIALOG and/or its employees harmless against any loss or damage or liability. However, any recovery under the said bank guarantee shall not relieve the Merchant from the obligation to comply with the terms and conditions under this Agreement or under any other law.

5.6 The Merchant shall encourage customers to make payments through GENIE when making payments for transactions.

5.7 ACCESS CREDENTIALS

a) The Merchant shall be responsible for ensuring the security of the access credentials provided to him to access GENIE. If a third party accesses the GENIE Account using the access credentials provided to the Merchant, with or without his authorization, for all intents and purposes such access shall be considered an authorised access.

b) The Merchant shall use the GENIE access credentials solely for the Website and/or mobile application specified in the Merchant’s Application.

5.8 The Merchant shall keep all customer information confidential and shall not use such information for any other purpose except for the purpose of fulfilling its obligations under this Agreement.

5.9 The Merchant hereby confirms that its personnel have been adequately trained in the GENIE procedure.

5.10 The Merchant shall not engage any third party in the Transactions without the prior written consent of DIALOG.

5.11 The Merchant agrees and accepts that all documents and directions issued by DIALOG in writing relating to GENIE from time to time shall form part and parcel of this Agreement.

5.12 USE OF NAMES AND LOGOS

The Merchant shall prominently display in the place or places of business nominated, GENIE details, insignia and other material provided by DIALOG for the purposes of display and shall notify the public that payments for transactions can be made through GENIE. The Merchant hereby irrevocably authorizes DIALOG to include the name and logos of the Merchant, in any advertising or promotional material in connection with GENIE.

5.13 The Merchant shall ensure that the Transactions are reconciled against the Genie portal on a daily basis. In the event of any discrepancy, the Merchant shall contact the Genie relationship manager immediately. The decision of DIALOG with regard to such discrepancy based on the detailed transaction logs maintained by DIALOG shall be final.

5.14 REPORTING

The Merchant shall maintain a monthly report with the full details of the Transactions concluded through GENIE by the Merchant for the respective month and submit the same to DIALOG. In the event of any dispute relating to the settlement of the Commission Rate for the said month, the Parties shall endeavour to resolve all such disputes amicably, failing which however the decision of DIALOG with regard to such dispute based on the detailed transaction logs maintained by DIALOG shall be final.

5.15 The Merchant shall allow DIALOG to visit and examine the books of accounts and any other records connected with GENIE and/or GENIE Transactions with prior notice and the Merchant shall co-operate with the representative of DIALOG to the best of its ability to facilitate this process.

5.16 WEBSITE / MOBILE APPLICATION REQUIREMENTS

The Merchant shall ensure that the Merchant’s website and/or mobile application;

a) complies with the requirements reasonably imposed by DIALOG from time to time. The current requirements are set out in Schedule 2 hereto.

b) contains a prominent notice stating that the card payment transactions conducted with the Merchant comply with SSL or other security conditions approved by DIALOG in writing, which notice shall also feature therein the relevant marks as required by DIALOG to convey that the Website is a secure site.

c) does not contain any name, trade name, trademark, logo or other symbol of any bank unless specifically approved by such bank in writing.

d) does not contain any material that are of an illegal, pornographic, defamatory or scandalous character.

5.17 The Merchant shall provide reasonable assistance for the prevention and detection of fraud in respect of any Transaction as DIALOG may from time to time request.

5.18 The Merchant shall retain all documents and records relating to each Transaction for a period not less than six ( 6) years and produce the same to Dialog on request. Such documents and records shall contain information with regard to each Transaction such as but not limited to, transaction date, transaction amount, transaction currency, authorisation code, description of goods and/or services supplied.

5.19 In respect of each Transaction, the Merchant shall provide to the customer a record of such Transaction (by electronic means, surface mail or other methods acceptable to DIALOG) which shall include all or as applicable, the information contained in Schedule 3 hereto.

5.20 The Merchant shall inform DIALOG of the occurrence of any of the information contained in Schedule 4 hereto, in writing prior to its effective date.